It has been a while since I have not written anything on alstria’s blog. I started from time to time, but never get to finish the work. This morning however, when I read the piece about the German real estate, that was featured in the daily newsletter of Property Investor Europe (which is usually the first think I read in the morning), I knew I would get through.

The “Expert view”, which is

called “Upward trend on

the German commercial real estate market” (and available here: http://aox.ag/PIE_German_office

) gives an overview about why investors should be investing in the German

office sector, which per see, should not lead to any specific comments from my

side. Except that, when I finish reading the post, I suddenly felt younger by 7

to 8 years. If you want a list of all the bad reasons to invest in the German

office market, this post is definitely the right place to start. It is making 5

assumptions that should lead a decision to invest in German office space.

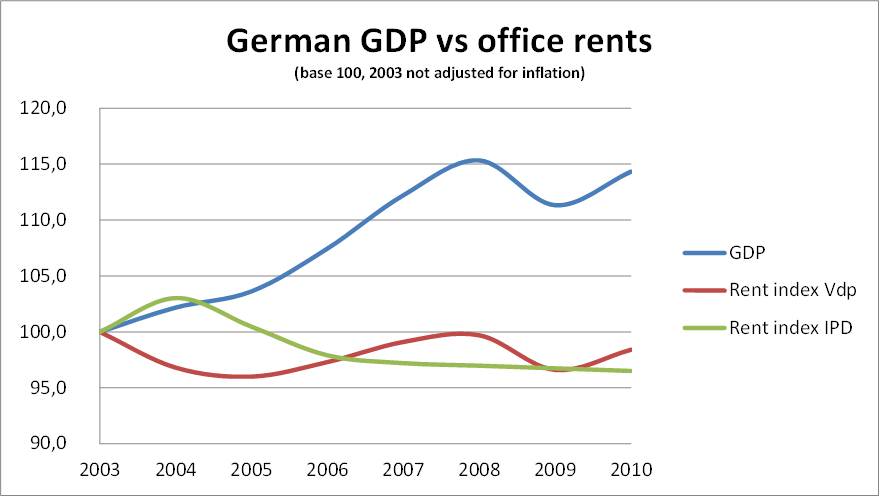

Assumption 1: Economic

growth in Germany is resulting in increasing demand for office space

This is a graph that was

published on this blog four years ago (and would lead to the same result if

extended to 2014).

I am amazed to see that

some commentators are still arguing about the fact the GDP growth correlate with

office rental growth. This might have been the case 30 years ago, but it is

clearly not the case anymore. The way tenants are learning to optimize their

office space, and the efficiency gain they are realizing are by far outstripping

any additional need of space created by GDP growth. Do not expect any substantial

rental growth in the German office sector, nor substantial vacancy reduction. It is unlikely to happen anytime soon.

Assumption 2: Financing of

commercial real estate is becoming cheaper

That is absolutely true.

Financing is cheap. I would have thought that I would never again hear this as

an argument for buying real estate (nota: alstria always underwrite assets

based on unlevered returns), but apparently I was wrong.

Assumption 3: Rising

demand for office premises with a positive impact on rental markets

See point one above. This has

never happened in the past, and I see no reason why it will happen in the

future. Absorption in the market is at best neutral, more realistically negative.

Assumption 4: Ongoing

investment pressure is driving transaction volumes and is reducing risk

aversion

The first part of the assessment is

absolutely correct, investment volume is going up, and has accelerated drastically

over the last weeks (mainly on long term leased assets, driven by yield

seekers). But I am not sure that risk aversion is reducing. Short term leased

assets, or other assets with potential operational risk/leverage are not so

much in demand. Not sure though that the risk aversion is reducing, but clearly

the risk return profile of some of the assets which are being considered for

trading is deteriorating.

So what is the German office market all about then ?

Obviously we all have our views

on the market and how it is going to develop, and mine is as good as any other.

The fact of the matter is that our position is based on an educated guess, not a crystal ball. We

believe that the German office market is going to be driven by operational excellence,

vs. financial engineering. That real estate needs more operators and less

financial sponsors. that driving returns should come from increased market share, better scaling of costs, operational excellence, better services to the clients (some call them tenants). That expectation of market rental growth driven by macro factors, should not be considered, and will only enhance returns if its happens.

In my last roadshow meeting, when

I was discussing the state of the investment market and the increased

transaction volume we are seeing in Germany, I was asked by an investor if I felt

any similarity with 2006-2007. My answer at this point was that I did not, as I

believed most of the players in the market still have the deep scares and bad memories

of what happened then. I think it is Mark Twain who once said "History does not repeat itself, but it does rhyme". Well PIE this morning was rhyming very strongly with 2007 (and if in doubt here are the same arguments put together in 2007:

At that time DB concluded as follow:

"The greatest risk in the years ahead therefore lies not in a downswing on the property markets, but in exorbitant expections on the part of investors and project developers"

I guess this last point is still up-to-date