A real estate analyst recently wrote that “In the real estate industry especially, buy and hold investment approaches are in essence simple spread businesses. Spread means the difference between rental yields (in our example we took gross rental yield based on in place rents) and the cost of interest-bearing debt (CoD).”

This vision of real estate is as far as reality as one can be, and ignores that running a (permanent) real estate business is much more an operational task than a financial gimmick.

Ignoring the physical reality of a real estate asset (it is depreciating over time, and need much care an attention), is a proven recipe for disaster, and had led not so long ago to a substantial amount of tears.

Our approach to real estate is for and foremost operational. Our underwriting of real estate is unlevered, in order not to cloud our judgment with cheap debt, and easy money. alstria will benefit from the low interest rate environment in the future, and the implied increased carry on our assets. However, this is done on assets which have an intrinsic value, beyond the cheap cost of funding. This value is underpinned by business plan that rely on reasonable market assumption, and more importantly on the ability to implement this business plans. Not on the biggest fool theory.

This approach has allowed us to increase our FFO per share systematically over the last 5 years, and allows us yet again to guide to an increase for the year to come. Achieving this result was possible thanks to a strong investment in our real estate operations, the dedication of our people to operation of the assets and the emphasis we put on our sticking to our strict underwriting criteria. We see no reason to change this approach, as we believe this is the only sustainable way forward. Carry trade in real estate is a dead wrong approach.

Jan 16, 2015

Dead wrong

Labels:

accounting,

carry,

governance,

Hamburg,

IFRS,

interest rates,

investment,

real estate,

trade,

yields

Oct 25, 2014

The #GRESB Conundrum

We have been asked by a number of investor the reason why we have decided not to submit our data to GRESB this year (the data itself is available on our website www.alstria.com/sustainability ).

In order to better explain our position we have used the following presentation.

We are obviously happy to discuss, so please feel free to send us feedback.

In order to better explain our position we have used the following presentation.

We are obviously happy to discuss, so please feel free to send us feedback.

Labels:

building,

CSR,

environment,

green,

green buildings,

GRESB,

investor,

IR,

real estate,

reit,

relation,

responsible,

sustainability

Jun 11, 2014

This time it is different

It has been a while since I have not written anything on alstria’s blog. I started from time to time, but never get to finish the work. This morning however, when I read the piece about the German real estate, that was featured in the daily newsletter of Property Investor Europe (which is usually the first think I read in the morning), I knew I would get through.

The “Expert view”, which is

called “Upward trend on

the German commercial real estate market” (and available here: http://aox.ag/PIE_German_office

) gives an overview about why investors should be investing in the German

office sector, which per see, should not lead to any specific comments from my

side. Except that, when I finish reading the post, I suddenly felt younger by 7

to 8 years. If you want a list of all the bad reasons to invest in the German

office market, this post is definitely the right place to start. It is making 5

assumptions that should lead a decision to invest in German office space.

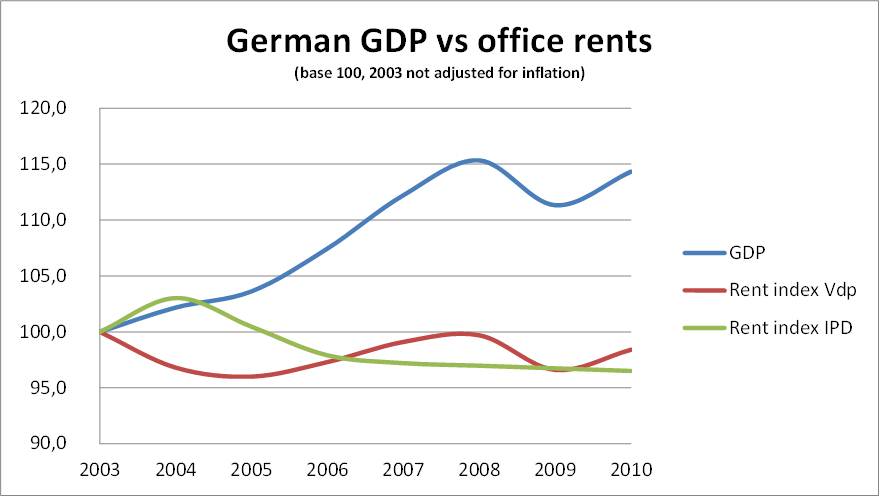

Assumption 1: Economic

growth in Germany is resulting in increasing demand for office space

This is a graph that was

published on this blog four years ago (and would lead to the same result if

extended to 2014).

I am amazed to see that

some commentators are still arguing about the fact the GDP growth correlate with

office rental growth. This might have been the case 30 years ago, but it is

clearly not the case anymore. The way tenants are learning to optimize their

office space, and the efficiency gain they are realizing are by far outstripping

any additional need of space created by GDP growth. Do not expect any substantial

rental growth in the German office sector, nor substantial vacancy reduction. It is unlikely to happen anytime soon.

Assumption 2: Financing of

commercial real estate is becoming cheaper

That is absolutely true.

Financing is cheap. I would have thought that I would never again hear this as

an argument for buying real estate (nota: alstria always underwrite assets

based on unlevered returns), but apparently I was wrong.

Assumption 3: Rising

demand for office premises with a positive impact on rental markets

See point one above. This has

never happened in the past, and I see no reason why it will happen in the

future. Absorption in the market is at best neutral, more realistically negative.

Assumption 4: Ongoing

investment pressure is driving transaction volumes and is reducing risk

aversion

The first part of the assessment is

absolutely correct, investment volume is going up, and has accelerated drastically

over the last weeks (mainly on long term leased assets, driven by yield

seekers). But I am not sure that risk aversion is reducing. Short term leased

assets, or other assets with potential operational risk/leverage are not so

much in demand. Not sure though that the risk aversion is reducing, but clearly

the risk return profile of some of the assets which are being considered for

trading is deteriorating.

So what is the German office market all about then ?

Obviously we all have our views

on the market and how it is going to develop, and mine is as good as any other.

The fact of the matter is that our position is based on an educated guess, not a crystal ball. We

believe that the German office market is going to be driven by operational excellence,

vs. financial engineering. That real estate needs more operators and less

financial sponsors. that driving returns should come from increased market share, better scaling of costs, operational excellence, better services to the clients (some call them tenants). That expectation of market rental growth driven by macro factors, should not be considered, and will only enhance returns if its happens.

In my last roadshow meeting, when

I was discussing the state of the investment market and the increased

transaction volume we are seeing in Germany, I was asked by an investor if I felt

any similarity with 2006-2007. My answer at this point was that I did not, as I

believed most of the players in the market still have the deep scares and bad memories

of what happened then. I think it is Mark Twain who once said "History does not repeat itself, but it does rhyme". Well PIE this morning was rhyming very strongly with 2007 (and if in doubt here are the same arguments put together in 2007:

At that time DB concluded as follow:

"The greatest risk in the years ahead therefore lies not in a downswing on the property markets, but in exorbitant expections on the part of investors and project developers"

I guess this last point is still up-to-date

Labels:

alstria,

capital,

crisis,

equity,

europe,

german,

germany,

increase,

investment,

investor,

real,

real estate,

reit,

transactions,

valuation

Jan 8, 2013

Socially Responsible Investment

What if one equity research firm

was to send to a company it covers a questionnaire asking specifically for

nonpublic information. This would be done in order to provide its clients with

a “more accurate picture” of the company that what is achievable through public

disclosure. How would the company react? And how would the compliance

department of the research firm react?

You think no one would do that?

Think again. It is done every year for a significant number of companies among

the most respected one. It is done every year by research firm that publish

report about the Corporate Social Responsibility (CSR) of issuers. It is to a

certain extend ironic that these questionnaires will all circle around

corporate governance and compliance issues. In order to fill them, you need to

break one basic rule of corporate governance: Equal treatment of shareholders.

I realized this was the case,

following changes at the GRESB (www.GRESB.com),

a real estate CSR benchmarking non-profit group. We have been submitting data to the GRESB for

the last two years (Our latest answers can be found here http://aox.ag/UzTCzV). What I, and probably a

number of other companies initially overlooked, is that the GRESB is not only a

benchmarking tool. In actual fact the data we would submit to GRESB would be

re-used by GRESB, and fed into (paid?) research, that would be provided to

selected investors.

My first reaction was to write

the GRESB management a letter explaining that I did not felt that this was

appropriate. However, before drafting such a letter I have done some research

about how other do it. The most prominent of theses research firm (as they

provide the research for Footsie4Good) is EIRIS (www.EIRIS.org).

Much to my surprise, they actually openly and specifically mention that they

would ask companies for non-public information. The headline on the company

survey page reads as follow: “The EIRIS

survey is a way for us to get the information that our clients require that

is not already publicly available.” http://www.eiris.org/companies/eiris_survey.html

You might argue that this kind of

information is not relevant for the investment decision. However, it seems

important enough for AXA, BlackRock, and a number of other high profile

investor to pay to get access to this information. It is also interesting to

see that this information will then be available (against payment) on websites

like www.CSRhub.com

Another high profile CSR adviser SAM (which deal with the Dow Jones sustainability index) is less explicit about the nature of the information it asks companies to report on. The website mentions that : "The annual assessment is based on an online questionnaire supported by extensive company documentation" http://www.sam-group.com/en/sustainability-insight/sam-corporate-sustainability-assessment.jsp

Anyway, this does not

seem to have been caught up by any regulator, which tends to demonstrate that

non-financial information is not considered as critical by regulators.

From today on, alstria will

publish on its website the full extent of the questionnaire that we fill up to

these kind of research firms, in order to make sure everyone have access to the

same level of information. I will also still ask GRESB what their position on

the topic is. It might as well be that I have it all wrong.

Labels:

CSR,

EIRIS,

GRESB,

insider,

real estate,

shareholders,

SRI,

sustainability,

trading,

transparency

Dec 21, 2012

Life Insurance

The say on the street is that

there is a funding gap in the European property market. The say is also that

new players are coming along to fill, or benefit from this gap. These new

players are called debt funds, or insurance companies. Reports are piling up

announcing the raise of new funds, or the billions that this or this insurance

company is planning to invest in the new yield Eldorado. Advisors are warning

about banking regulation risks looming on the new sector, and offering advice… And

journalist have been writing about it (for instance here http://aox.ag/12tjxdn, here http://aox.ag/12tjw9c and here http://aox.ag/TbXMdh )

I have been wondering how much of

all of this is actually for real, and how much is there to help us sleep at

night. The white knights are coming to save our industry from its own cliff.

The fact is that there are a

number of high profile loans which have been put together by insurance

companies (not so much by funds so far). The Deutsche Bank and the Silber

Towers in Frankfurt, some prime assets in London… So there is some action going

in there. But is that really new? In the syndicated facility of alstria back in

2007 we also had AXA as part of the consortium with one of its debt fund

(alongside with 25 banks). Today we do have a fund from Deka as part of our

banking syndicate.

We also hear that unlike in the

US, insurance companies have never really be involved in the financing of real

estate in Europe. This is not exactly true. The lion share of the Pfandbrief

bonds (the German cover bond market which finance real estate across Europe)

are actually sold to insurance companies (although we could not identify any statistic

in that respect). According to the Vdp, the total amount of Pfandbrief loan

outstanding in Europe at the end of 2011 was around EUR 297 billion. The

pfandbrief banks granted EUR 90 billion of new real estate loan in 2011. This

compares with, for instance, Allianz target of EUR 5 billion loan book by 2015 (

http://aox.ag/UhbZHW )or the total EUR 2

billion of new loans by insurance companies in 2011…

From my perspective, the key

question in this debate is not really whether or not insurance companies will

step in the lending business. But are they going to do this with new capital,

or is the lending business just part of the existing real estate allocation. GE

Real Estate for instance (which I appreciate is not an insurance company, see

here http://aox.ag/T3EytC ) is stepping out

of equity, and coming back into debt. Net net, the move is neutral… No new

capital.

Labels:

allianz,

covered bond,

debt,

equity,

europe,

insurance,

life,

pfandbrief,

real estate,

reit

Nov 20, 2012

Adding the numbers

A short mathematical problem for my eight years old son to solve:

· At 30/09/2011, the total NAV (Net Asset Value)of the German open ended funds was 85.151 mEUR.

Assuming that over the period the asset value is only influenced by net flows, can you calculate how much theses in(out)flows are ?

Here is my son’s answer (and any other kid for that matter):The total flow for the period is equal 83.173 – 85.151 = - 1.979. Given that this number is negative, this is an OUTFLOW.

Here is my son’s answer (and any other kid for that matter):The total flow for the period is equal 83.173 – 85.151 = - 1.979. Given that this number is negative, this is an OUTFLOW.

You think this is obvious. Well it is not. At least not for the Bundesverband Deutscher Investment-Gesellschaften or BVI. For the German Funds Association which states that “it enforces improvements for fund-investors and promotes equal treatment for all investors in the financial markets. BVI`s investor education programs support students and citizens to improve their financial knowledge”, the simple math above do not work.

According to the BVI the correct answer to the question above is a net INFLOW of EUR 2.766 mEUR. In other words 83.173– 85.151 = +2.766…

This is not an isolated mistake. If you look for the BVI net inflow publications for real estate open ended funds from 2007 to 2011 theses are the numbers you will dig out:

While “NET inflow” for the period was around EUR 13.7 b, the total NAV of the funds grew by a little less than a 10th of that. How does this work?

In order to understand the forces at work, you need to take a look at the same set of numbers, published this time by the Deustche-Bundesbank. The Bundesbank publishes two additional numbers. One is the total outflow, and the second one is the total distribution paid. The Bundesbank also make it crystal clear that the NET-inflow numbers disregard any distribution.

The previous table looks like this in the Bundesbank report:

With this additional information the numbers make sense (the reason why the numbers do not add-up exactly is because of the underlying performance of the funds which impacts the NAV). The so called Net Inflow, is for the most of it, not more than a dividend re-investment scheme. It has NO influence whatsoever on the amount of money available to invest in real estate.

The information which is has been provided by the BVI to the market for years is highly misleading. The vast majority of the market participants believe that the net inflow which is publish is what it name says it is: Net inflow, ie. new money that is coming into real estate. Here are a couple of example of some investors/advisors that have been across the years willingly or not mislead by the BVI communication.

Google will provide you with dozens of other examples. Since the publication of the last BVI figures last week, I have received at least 5 daily emails of investment banks mentioning the fact that open-ended funds had EUR 2,7 b of inflow year to date. All of them were hinting to the fact that this money will need to be invested (at least partly), therefore driving demand. This is just not the case. In actual fact, the total amount of money available for investment in real estate went DOWN.

The BVI recently published an analysis where it found that there are significant deficiencies in the corporate governance of German listed companies. That might as well be true. But assuming the BVI really cares about the topic, I would strongly encourage them to start cracking at their own issues first.

NB: all the numbers quoted in this post are sources from:

http://www.bundesbank.de/Navigation/EN/Publications/Statistical_supplements/statistical_supplements.html (supplement 2 as of 28/09/2012)

May 23, 2012

Green Lanterns

IPD has started an interesting

new index in the French market, called the IPD Green Real estate index. It

basically analyses the performance of Green buildings and compares it with both

recent non-green buildings as well as with the general IPD index (http://aox.ag/KdpWzJ)

As far as I know, this is the

first time such an indicator is put together. This is more than welcome

initiative as it might once and for all stop the rhetorical debate about whether

or not Green adds value to the asset.

On the face of it, it looks as if

it does add value. Total return last year for the green building stood at 7,4%.

That is 1,1% higher than equivalent non green building which showed a total

return of 6,3%. However devil is in the details.

Here is how this performance is

broken up:

The green building performance is

solely driven by a (theoretical?) capital value improvement. It relative

performance is very poor in turns of Income Returns with assets yielding around

2% less than the rest of the market. More interestingly the IPD data reveal that

there is no rent difference between Green and non-green buildings (average ERV

is at 356 EUR/sqm/year for non-green vs 361 EUR/sqm/year for green building).

These data allow for an interesting

(theoretical) analysis about the benefit of investing in the green building. Let’s

assume a green office building which is worth 100. According to IPD data, this

asset will generate around 4,2 of rent. Let’s now assume a non-green building

asset generating the same rent. According to IPD this asset is yield 6,3% ie.

is worth 66,7. From there you can derive the actual value as described in the

following table.

As a result of the IPD data, you

can determine in a few minutes that the market offers a 71% premium for the

value of a “Green” construction over a non-green construction. At this stage it become clear what you want to build if you are a developper. The only economical explanation for such a premium would be that a green building will depreciate much slower than a non-green

building. It would therefore deserve a premium as it would deliver returns on a longuer period of time.

The table below, summarizes the

number of years needed to collect enough rent in order to pay for the

construction cost at a given unlevered expected return (the NPV of the cash

flow is equal to zero).

What the previous table show is that If you expect a 5% return from a non green building, assumes no terminal value, no rental growth, no capex... you need to collect the rent for 16 full years. For a green building for which a 71% premium was paid, you need to collect rent for 54 years. Another way to say this is that the premium reflect the belief that the green building life will be 3,3 times longuer than the non green building.

So now, here is the question:

Which assets do you think is going to generate the most sustainable returns

over time? I am not going to take position. However I have lost faith long ago

in Hal Jordan and the believe that “Green is the color of will”

Labels:

DGNB,

green buildings,

IPD,

listed companies,

market,

MIS-LEED-ING,

real estate,

reit,

sustainability,

transparency

Apr 26, 2012

It's a wonderful life

An interesting development in the life of the open-ended fund industry has hit the news today.

In a press release published today (http://aox.ag/IGAUNd), SEB ImmoInvest is trying to achieve what none of its peers dared to try before. Move from a bank run situation back to a stabilized situation. They are doing so by pointing on to shareholders the actual consequence of the run.

The last sentence of the press release that quotes current SEB Asset Management CEO goes as follow:

Barbara A. Knoflach: “We are asking our investors to consider the alternatives and, by staying invested, to commit to a future of the fund that could very well live up to its successful 23-year track record. The only chance to avoid the liquidation of the fund with all its consequences is not to take advantage of the exit offer.”

I would like to state clearly that this is a very brave move, and indeed, in my view, the only way to put any of the closed funds back into action.

I have discussed in a previous post the interesting game theory issue that the closure of open-ended fund closure was posing (http://aox.ag/JpQleh). Any one who took the time to run this game would have figured out that this could only work out positively if players increased COOPERATION. This is exactly what SEB is trying to do. Again that is the right thing to do.

However, I need to point out to one major weakness in the way this is done. There is a lack of clarity on the potential outcomes for each scenario (going concern or liquidation). For cooperation to work and players to see a benefit in cooperation they need to understand that cooperating in the game will lead them to a higher benefit (payout) that acting individually (which in this case end up in a run). While to some extend this is suggested by the press release (the liquidation of the fund AND ALL ITS CONSEQUENCES) it is not explicitly said that a run will probably end up in a much lower payout… To the contrary its insist on the quality of the underlying portfolio as an argument to keep the fund running. If holders believe that they will get the same value in liquidation than in a going concern, than the cooperation will simply not work.

I do not know any real life example of any thing like this being done before on such a scale (but would be interested if anyone have any knowledge of this). I can however recall James Steward managing to save its bank with 2.000 dollars in the 1946 It’s a wonderful life movie. Looking back at the scene of the bank run might be a good idea, to understand how he got people to cooperate… http://aox.ag/Ijy0Rn.

Labels:

game,

germany,

Open Ended Funds,

theory

Subscribe to:

Posts (Atom)